What is ROI And How to Calculate It

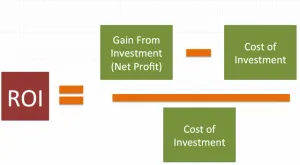

Return on investment (ROI) is used in finance as a means of measuring profitability. This metric is applied in order to measure the gain from an investment. Basically, it can be understood as a ratio between the gain from the investment and the associated costs. It assesses efficiency in both the evaluation of the probable return from a single investment and in the comparison of returns from several fields.

How to Calculate ROI

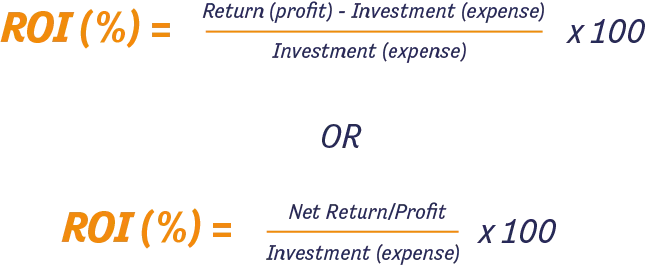

The calculation of ROI is just a simple economic formula. It can be calculated via two simple methods – one using profit and cost definitions, the second simply by applying Investment terms.

How to interpret ROI

This is what to keep in mind when talking about ROI calculations:

- To make it more understandable, our experts suggest representing ROI as a percentage instead of a ratio.

- "Net return" is more appropriate than "net profit or gain" in the numerator when carrying out the ROI calculation: returns from an investment are often negative rather than positive.

- A positive ROI figure is when net returns are in the black, because total returns are larger than total costs. A negative ROI figure implies that net returns are in the red (which means that the investment was a loss) and that total costs are more significant than total returns.

- To calculate ROI with increased precision, one needs to consider both total returns and total costs. For an apples-to-apples comparison between two or more competing investments, take into consideration the annualised ROI.

ROI Estimation Planning

Everything is set and clear when you’re in the same business for years and already have all the figures. But how do you plan ROI and calculate the break-even point for a totally new project?

ROI calculation for startups

The calculation will be the same, but instead of actual figures, we’ll cope with a forecast.

Five steps to be prepared for the estimation of future ROI:

1. Estimate the whole market volume.

2. Assess what market share you can cover within the 1st year.

3. Plan all your expenditures (fixed costs and variable costs)

4. Calculate your profit and don’t forget to subtract the taxes.

5. Implement the same calculation as you would when working with the real figures.

It’s time to go through some practical cases:

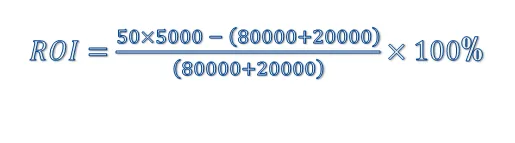

You plan to invest 80K GBP in the development of a SaaS platform for advertising agencies, plus 20K GBP for support and promotion of your SaaS onto the market.

Let’s clarify the initial conditions:

- this app can be used by all local marketing teams.

- there are 10 competitors with similar functionality on the market.

Suppose all of them have an equal chance of securing a customer.

- Your market share goal will be 1/10 of the market.

- Average subscription price is fixed at 5K GBP per year.

- The total number of potential customers 500.

- Your 1/10 is therefore 50 customers with 5K each.

This can be estimated as 150%. This means you’ll get 50% of profit if you don’t forget to calculate the taxes.

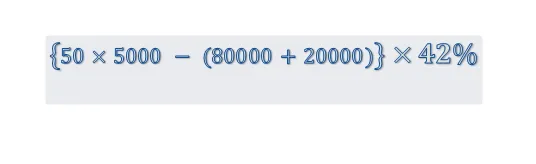

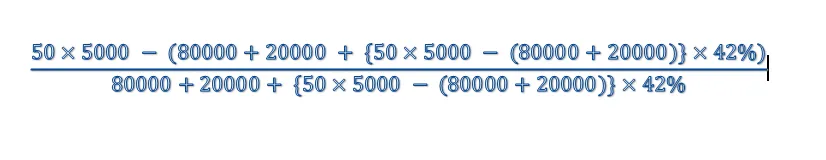

Let’s calculate ROI once more with taxation (here are the average figures for tax rates in the UK – for a 100 000 GBP sum, it stands at 42%):

Taxes:

Result of such calculation:

|

Profit |

87000 |

|

Expenses |

163000 |

|

ROI |

53.37% |

What does it mean to you?

Your net profit is positive. So, it’s great to earn some money within the first year of project implementation.

But your ROI of 53.7% means you’ll earn an extra half from your investment.

So, you end up with less than what you initially paid. But this isn’t bad at all – the software development investment was a one-time expense. In this particular case, we’ll only need to pay the standard 20K GBP as supportive costs for the second year.

Based on this example, your project is brilliant – within one year you’ll overcome the break-even point and will be in the blue.

- But in case your ROI is about 10%, this means you’ll need more than 10 years to get out of the red. On a changing market, such projects are very risky. Check this article about some reasons to be alarmed with market changes or government policies.

The next point to bother about is a market volume estimation.

Volume estimation

This is a really difficult question, but there are several ways to solve it:

Option 1. Check open-source data – some official researchers may have already published the market size estimation and forecasts for the next 2-3 years, as seen here.

Option 2. Working in a very small niche or implementing something totally new demands the realisation of independent research. Some R&D companies can assist you in this case, or you can organise them with your in-house marketing team. Just keep in mind the representativeness of data and a strong mathematical basis when handling it.

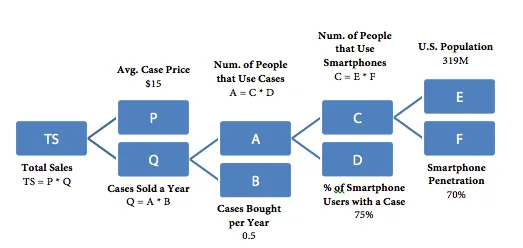

Option 3. You can do a rough estimation. For your business model, it’s enough to understand the capacity without collecting the exact figures.

So, read about this brilliant method of order estimation called the Fermi quiz – you can do it yourself. Here is how this method looks:

To summarise:

- By my mind, the most difficult part of your ROI calculation is to create a realistic forecast of your future earnings and scrupulous planning of all the expenditures.

- By detailed arrangement and control of all the costs and achievement of planned sales volumes, you’ll be able to implement the vision of your business prospects and ROI.

If you need a more detailed consultation to get an understanding of how your software development ROI estimation can be implemented, contact our app developer team.